Zibo Yunneng Kiln Technology Co. Ltd. Zibo Yunneng Kiln Technology Co. Ltd.

Free delivery samples

high quality assurance

Engineer's door-to-door guidance

lifelong technical support

Contact us+86159669653330086-533-5331887

Zibo Yunneng Kiln Technology Co. Ltd. Zibo Yunneng Kiln Technology Co. Ltd.

Free delivery samples

high quality assurance

Engineer's door-to-door guidance

lifelong technical support

Contact us+86159669653330086-533-5331887

Home -> News -> News -> Industry News ->

At the Third Secretary-General Meeting of the Third Session of the China Nonferrous Metals Industry Association's Geological and Minerals Branch held on March 13th, in 2014, the national non-ferrous geological survey team completed a total of 1,298,600 meters of drilling work; the pit exploration workload was 53,900 meters, trench exploration The workload is 1,392,000 cubic meters, and the well inspection workload is 17,400 meters. A number of mineral reserves such as copper, lead, zinc and tungsten are added.

According to incomplete statistics, in 2014, the national non-ferrous geological survey team implemented 2,253 new geological projects and submitted 1988 geological reports, and added a batch of non-ferrous metal mineral reserves (metal content): copper, 1.87 million tons; lead Zinc was 2.871 million tons; tungsten was 192.15 million tons; molybdenum was 718,300 tons; tin was 125,500 tons; 锑67,500 tons; nickel was 52,800 tons; gold was 780.10 tons; silver was 3,276.38 tons; bauxite (ore content) was 110.88 million tons.

However, the situation faced by the non-ferrous geological survey team is not optimistic. Participants pointed out that the decline in fiscal investment, the lack of social investment, and the decline in unit efficiency have become the three prominent features of the new normal of geological work. According to incomplete statistics, in 2014, the geological project fees obtained by the national non-ferrous geological prospecting units from the central and local financial channels were 494 million yuan and 829 million yuan, respectively, which decreased by 23.25% and 5.72% compared with the previous year; The income from work projects was 3.991 billion yuan, a decrease of 30.74% compared with 2013. In the case of both financial and social capital investment, the total income and profits of the national non-ferrous geological survey team also dropped significantly. In 2014, the national non-ferrous geological survey team realized a total economic income and profit of 26.188 billion yuan and 1.194 billion yuan, respectively, down 28.33% and 38.32% from the previous year.

Non-ferrous metal refers to the general term for all metals except ferrous metals composed of iron, manganese and chromium. It is an indispensable material for the development of modern industry, modern national defense and modern science and technology. Although the current operation of the non-ferrous metal industry continues to be stable and good, the foundation for stability is still not stable. Affected by the economic environment, the price of non-ferrous metals is still at a low level. The pattern of business difficulties has not changed significantly. The profit of the main activities of enterprises still shows a downward trend. The market order still needs to be standardized, and the ability of innovation and industrialization in high-end fields is still insufficient. The following is an analysis of the current status of China's non-ferrous metals industry in 2014:

First, the problem of overcapacity in the smelting industry is still outstanding.

This has become the most prominent problem in the non-ferrous metal industry in China. At present, most industries in China have excess smelting capacity, especially the overcapacity of electrolytic aluminum. The expansion of capacity is more serious in Xinjiang, Inner Mongolia and Shandong. According to recent verification, China's existing electrolytic aluminum production capacity has reached 31 million & mdash; 3200 Ten thousand tons, overcapacity has intensified.

At the same time, the current power supply methods for electrolytic aluminum enterprises in China include power grid purchase, self-supplied power plants, and direct power supply. Due to the power system in China, the current grid price is much higher than the power price of the self-supplied power plant, which encourages the construction of areas with electricity price advantages. Electrolytic aluminum. This has led to the disorderly expansion of production capacity in many regions with electricity price advantages, and has also caused many of the backbone enterprises that lack the competitiveness of electricity prices to suffer serious losses. Therefore, China's aluminum industry urgently needs to establish a fair and reasonable competitive environment, promote fair competition in electricity prices, and reduce unfair competition caused by institutional mechanisms.

Second, the high-end product development capability is weak, and the industrial structural contradiction is prominent.

China's non-ferrous metal industry's high-end product development capabilities are weak, and the overall low-end of the international non-ferrous metal industry chain, it is necessary to improve independent innovation capabilities and high-end product development capabilities. The data show that from January to November 2013, the average export price of copper and aluminum in China was US$8555/ton and US$3,402/ton respectively, and the average import price was US$9,950/ton and US$6,307/ton respectively. The import prices were respectively exported. The price is 1.16 times and 1.85 times. Affected by the slowdown in world economic growth and weak demand from major economies, the demand for non-ferrous metals at home and abroad has declined significantly. In terms of major non-ferrous metal varieties, both imports and exports of copper and aluminum products declined in January-November.

Third, the production cost is high, the company lacks competitiveness, business difficulties, and weak ability to resist risks.

Except for a small number of enterprises, most domestic smelting enterprises lack self-prepared mines or only a small number of self-provided mines. Most of the raw materials need to be purchased, and the smelting enterprises have poor economic benefits. For example, the profit of lead and zinc smelting industry only accounts for 20% of lead and zinc industries. %, mining profit accounted for 80%, electrolytic aluminum industry has its own power production capacity only accounts for 45% of the total capacity, electrolytic aluminum companies using net power losses.

In recent years, China's non-ferrous metal production capacity has expanded rapidly, but labor productivity, capital profit rate, and scientific and technological content have not increased simultaneously. In addition, the industry's overcapacity, resource and environmental constraints have risen, prices have fluctuated at a low level, and business operations are very difficult. Some electrolytic aluminum enterprises in the electricity price area have been discontinued. According to statistics, from January to October, the main business cost of 8,524 large-scale non-ferrous metal industrial enterprises (excluding independent gold enterprises) was 35,834.8 billion yuan, a year-on-year increase of 14.7%. At the end of October, there were 1,726 non-ferrous metal industrial enterprises above 8,524, an increase of 57 over the same period of the previous year, with a loss of 20.2%; the loss of loss-making enterprises was 30.34 billion yuan, a year-on-year increase of 0.1%.

For more detailed reports on the non-ferrous metals industry, please refer to the “2014-1919 China Nonferrous Metals Industry Market Status and Investment Strategy Analysis Report” published by Yubo Zhiye Market Researcher.

Prospects for the development of China's non-ferrous metals industry in 2014: maintaining stable growth

It is expected that in 2014, the production of non-ferrous metals industry will continue to grow steadily, and the output of ten non-ferrous metals will increase by about 8%. The prices of major non-ferrous metals in the domestic market are still fluctuating, and the possibility of further decline or substantial increase is not Large; the difficult situation of non-ferrous metal enterprises is difficult to change in the short term, and it is unlikely that profits will fall sharply. Specifically:

First, the macro environment affecting the development of the non-ferrous metal industry has changed.

From the perspective of the domestic macro environment, China's GDP has increased by more than 7.5% in 2013, and the completion of the annual plan is a foregone conclusion. After more than 30 years of rapid development in reform and opening up, it has now entered a new stage of structural transformation. At this stage, the conditions of resource endowment of labor, land and market have undergone some new changes. At present, domestic economic growth is still in a reasonable range and no large-scale fiscal stimulus will be introduced. From the perspective of the international environment, the US economy is slowly recovering, and the European economy is showing signs of recovery. The Japanese economy has rebounded, but the world economic recovery is generally slow. Coupled with the implementation of ultra-quantitative loose monetary policy in some countries, the appreciation of the renminbi is forced, and the labor price in China is also increasing. The difficulty in exporting non-ferrous metal products is increasing.

Second, the problem of industrial restructuring and overcapacity is difficult to solve in the short term.

The non-ferrous metal industry chain is “large in the middle and small in both ends”. The overcapacity of smelting, the lack of mine support capacity, and the shortage of high value-added products are generally at the low end of the international industrial division of labor. The United States and Europe advocated the return of industry. Emerging economies and China have formed homogenization competition. Before the merger, there will be more trade frictions, and the production capacity will be more difficult to transfer abroad. The problem of unreasonable structure and overcapacity is difficult to solve in the short term.

Third, increased resources, energy and environmental pressures

China's non-ferrous metal resources are relatively scarce, low quality, and highly dependent on foreign countries. They are not only costly, but also subject to people. The high energy prices and the orientation of energy policy are not conducive to the development of the non-ferrous metals industry. The public opinion also does not know much about the non-ferrous metals industry. It only knows that high-energy consumption of non-ferrous metals is not known.

Fourth, the price of non-ferrous metals rebounded weakly

The Fed’s monetary policy turned, the US dollar strengthened, and the financial attributes of metals such as gold and copper weakened, and did not support the rise in the price of metals denominated in dollars. The world's non-ferrous metal production capacity and output growth is greater than demand growth. The global non-ferrous metals are generally oversupply, and they do not support the rise in non-ferrous metals prices. The price of non-ferrous metals continued to fluctuate at a low level. Domestic electricity, environmental protection and labor costs have risen, and the pressure on non-ferrous metal enterprises to operate is still relatively high.

Relevant Product Display

Ceramic fiber rope

Ceramic fiber rope

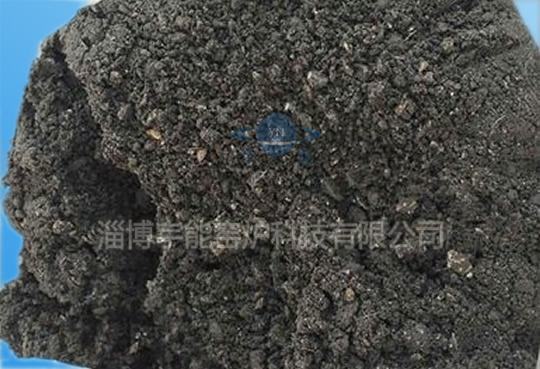

A new type of spalling resistant castable G-17P

A new type of spalling resistant castable G-17P

Refractory for ladle, heat preservation furnace, etc

Refractory for ladle, heat preservation furnace, etc

High resistance ramming material GT-2AS

High resistance ramming material GT-2AS

Relevant information

Hotline